In today’s housing market, ‘to each, their own’ is rarely used to describe current homebuyers. The more typical homebuying experience is ‘you get what you get and you don’t throw a fit.’ For many in the mountain states, a tantrum is happening because there are few attainable homes ‘to get’. Mountain States Policy Center recently looked into the cost of building and buying homes in the region and how to improve housing supply (here is our new study).

Housing affordability and availability are major concerns in the Mountain West. Housing choices across the region have restricted and the area is one of the most unattainable in the nation. From 2018 to 2023, Idaho and Montana saw the largest home price increases in the nation at 74% and 72%, respectively. These higher costs leave many homebuyers in a lurch between high rental costs and growing down payment requirements.

What do the local and state governments do in this housing crisis? The answer is not a government solution but a market solution. Government track records in the area of housing affordability are very poor. Many of the so-called government fixes, like rent control, make housing more unaffordable.

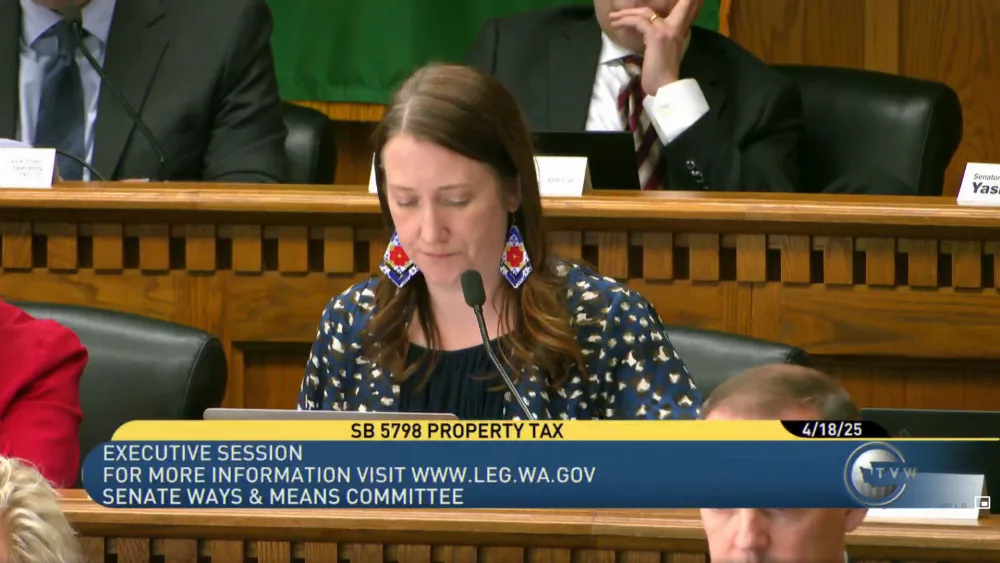

Just look at nearby Washington. It is one of the most unattainable places to build or buy a home in the region and has held that position for many years, especially around the Seattle-metro area. All levels of Washington government have created ‘fixes’ to the development problems facing the state. Limiting unwanted urban sprawl by severe growth management laws, protecting single-family residential zones from higher density housing, and pushing rent control and subsidized housing policies, to name a few.

The result. Home costs just climbed higher. Why? Because not one of these solutions fixed the basic economic tenant of supply. If home supply goes up, prices go down. A variety of policies tailored to local needs must aim for more housing, not government band-aids on a supply issue.

Idaho, Montana, and Utah have always been more affordable than neighboring Washington, but in the last four years, this has shifted as new residents flock to these states. These states are unaffordable because demand has increased, but supply has not grown by the same magnitude.

The Mountain West region is one of few areas where it is cheaper to build a home rather than to buy a home, primarily in the more rural areas. Lower land costs and fewer regulations, make it cheaper for homebuyers to build rather than buy a typical single-family home. But this trend disappears in more urban neighborhoods because there are typically more regulations, development costs, and a tighter supply of construction labor. These are self-inflicted consequences of local government choices.

How will the mountain states solve the housing crisis? The solution is allowing the market to supply houses.

There is a ‘swarm’ of small construction entrepreneurs available to create a better supply of homes in this region, but our policies need to be encouraging to these businesses. A few policy positions that improve housing supply include limiting building permit delays and complexity, encouraging light touch density development in highly demanded zones, not endangering property rights with growth management policies, avoiding excessive building mandates, and prohibiting artificial market manipulations like rent control and subsidies.

The housing attainability crisis our region faces is not going to be fixed through government solutions and funding. The attainability crisis is an availability crisis and our local policies need to improve housing supply with the market, not the government. Improved housing supply will grant homebuyers more attainable choices. Our region will be better off when it is easier to say of the choices we make as homebuyers, “to each, their own,” rather than ‘you get what you get.’

Note: This topic will be the focus of our Peak Policy update on March 1 at 12 p.m. MST. You can watch it live here on YouTube.